"A Signal Advantage of Taxes on Articles of Consumption." Thoughts by Alexander Hamilton, Federalist No. 21, Dec. 12, 1787.

After postulating that the Articles of Confederation committed a “fundamental error” in “principle” by attempting to regulate “the contributions of the States to the common treasury by QUOTAS,” Hamilton opined about the difficulty in determining a “common standard or barometer” by which the degrees of national wealth can be gauged. “The consequence,” Hamilton wrote, “clearly is that there can be no common measure of national wealth, and, of course, no general or stationary rule by which the ability of a state to pay taxes can be determined.” Moreover, Hamilton suggested that an attempt to impose some “stationary rule” on states that derive wealth from multifarious causes “be productive of glaring inequality and extreme oppression” that would “work the eventual destruction of the Union.”

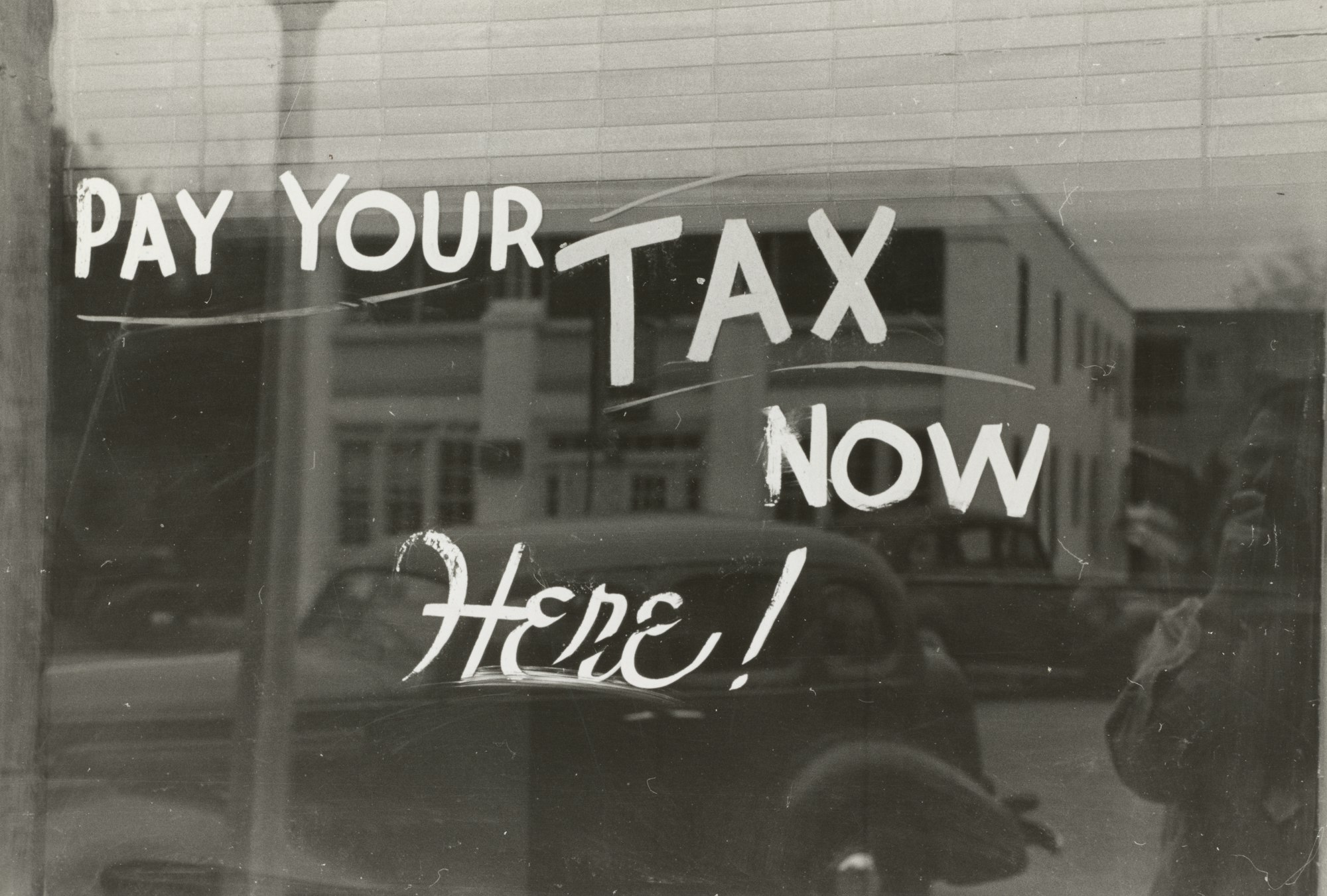

Hamilton suggested a solution to the problem in Federalist No. 21. Below is the most salient part of the suggestion.

August Glen-James, editor

It is a signal advantage of taxes on articles of consumption that they contain in their own nature a security against excess.

There is no method of steering clear of this inconvenience [i.e., attempting to raise revenue by requisitions or quotas of the States], but by authorizing the national government to raise its own revenues in its own way. Imposts, excises, and in general, all duties upon articles of consumption, may be compared to a fluid, which will in time find its level with the means of paying them. The amount to be contributed by each citizen will in a degree be at his own option, and can be regulated by an attention to his resources. The rich may be extravagant, the poor can be frugal; and private oppression may always be avoided by a judicious selection of objects proper for such impositions. If inequalities should arise in some States from duties on particular objects, these will in all probability be counterbalanced by proportional inequalities in other States, from the duties on other objects. In the course of time and things, an equilibrium, as far as it is attainable in so complicated a subject, will be established everywhere. Or, if inequalities should still exist, they would neither be so great in their degree, so uniform in their operation, nor so odious in their appearance, as those which would necessarily spring from quotas upon any scale that can possibly be devised.

It is a signal advantage of taxes on articles of consumption that they contain in their own nature a security against excess. They prescribe their own limit, which cannot be exceeded without defeating the end proposed—that is, an extension of the revenue. When applied to this object, the saying is as just as it is witty that, “in political arithmetic, two and two do not always make four.” If duties are too high, they lessen the consumption; the collection is eluded; and the product to the treasury is not so great as when they are confined within proper and moderate bounds. This forms a complete barrier against any material oppression of the citizens by taxes of this class, and is itself a natural limitation of the power of imposing them.